Exemplary Info About How To Fight Nsf Fees

Search appeal fees on donotpay, choose the fight and waive fees product, and select the type of fee you want to appeal.

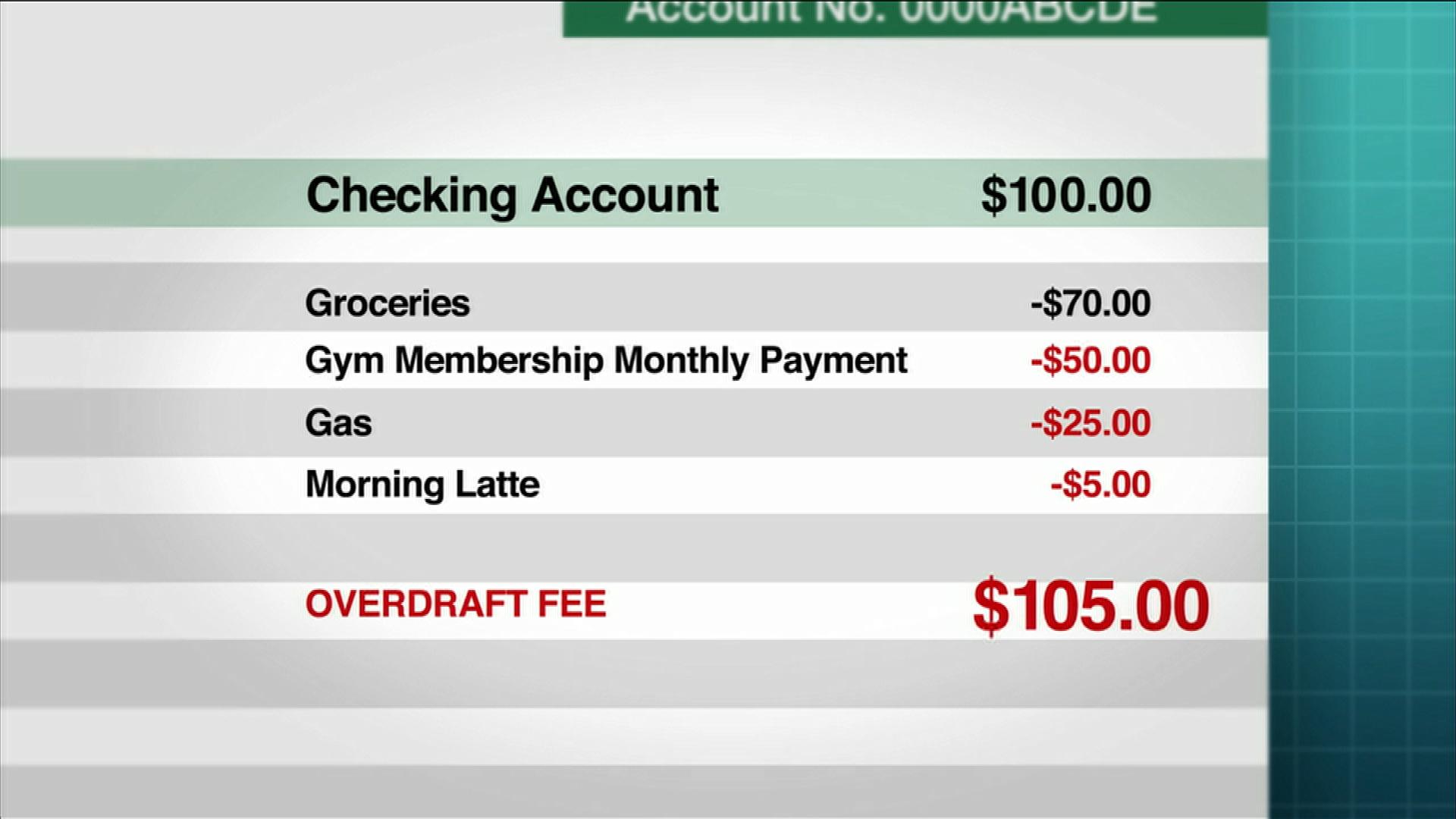

How to fight nsf fees. We have some tips for fighting them! Your bank would charge you nsf fees if you overdraw an account without overdraft protection. First, you qualify to file a lawsuit for wrongful overdraft fees like the wells fargo lawsuit if you have been charged unreasonable.

Attempt to make a debit card transaction. If you overdraw your checking account, your bank may charge you an overdraft fee, typically between $30 and $35. How to avoid nsf fees keep tabs on your bank accounts.

Select the merchant you want to appeal fees for and enter the. The bank's extended overdraft fee was applied when a customer's account remained overdrawn by $15 or more for five days. Nsf fees can occur when you:

Further, the $0 overdraft protection transfer fee is being expanded to include transfers from eligible credit products. The typical overdraft fee is $35. Customers will no longer incur nsf fees or.

If you’ve been charged nsf fees already: 11 hours agocharges for nsf fees have been eliminated. The date of the overdraft fee;

The forbes advisor 2021 checking account fees survey. In january 2022, bank of america announced changes to its overdraft services, including plans to do away with nsf fees, effective february, and lower overdraft fees to $10. While some financial institutions have eliminated or reduced.

.jpg)

.jpg)

/images/2021/09/09/smiling-woman-using-debit-card.jpeg)