Build A Tips About How To Become A Chartered Accountant In Ontario

How to become a chartered accountant.

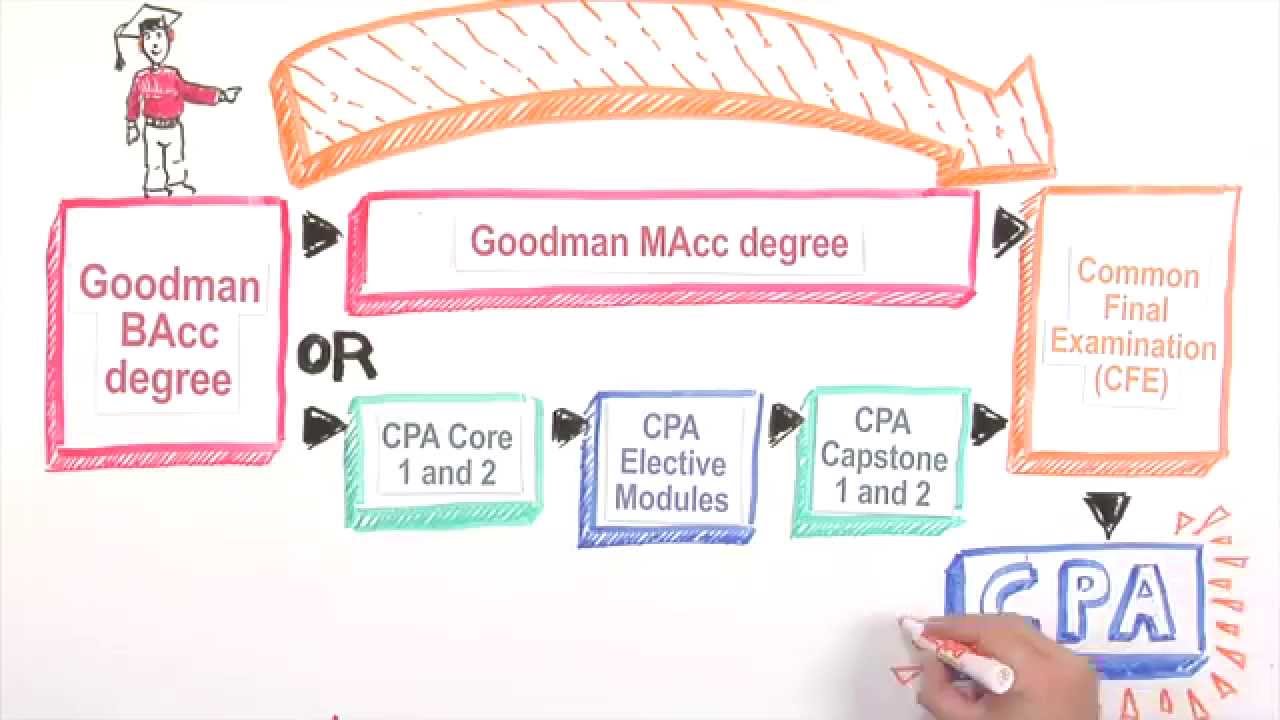

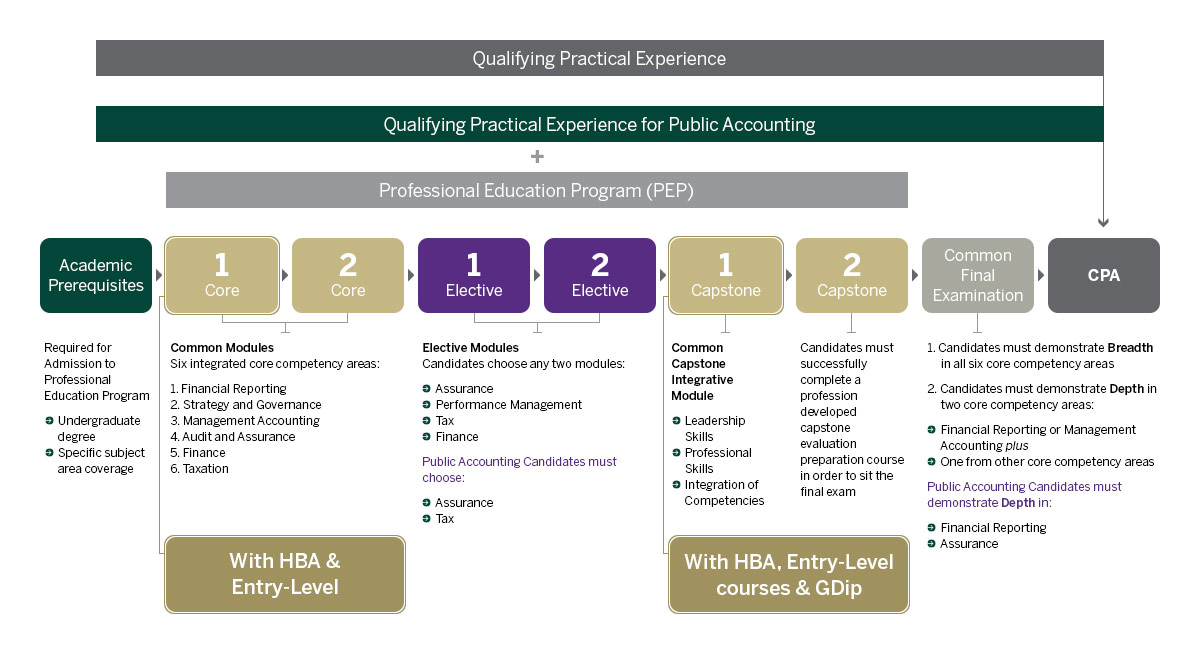

How to become a chartered accountant in ontario. If you already have an undergraduate degree with an accounting focus, then follow this default route to become a cpa in canada. If you are a member of a professional accounting body outside of canada, becoming a cpa in ontario may be easier. You then complete the cpa.

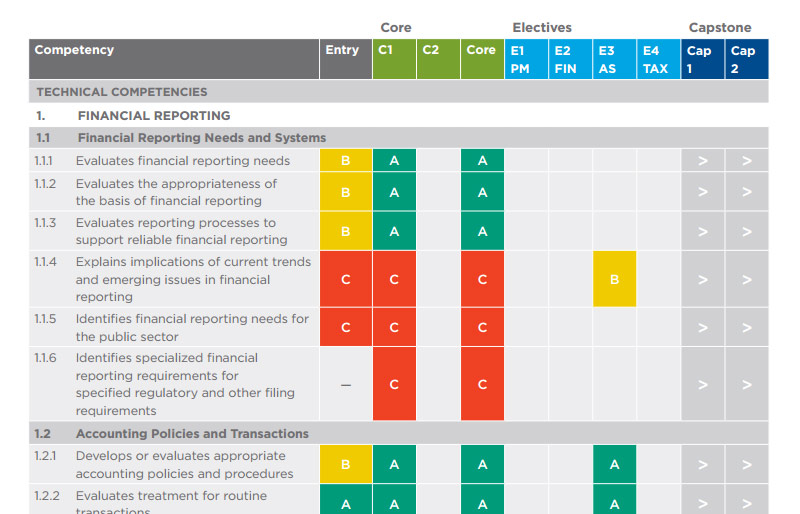

First and foremost, you will need to acquire your bachelor of science degree in accounting, regardless of what you have. Eligibility cpa ontario is responsible for promoting and. The process by which one becomes a chartered accountant in canada consists of four major components:

A grade 12 english course and one grade. During times of slower than average job growth, this speaks well of the strength of the industry and is encouraging news for those interested in becoming accountants in ontario. Top resources to become a cpa in canada.

There are 14 required prerequisite. Cpa ontario will use the transcript assessment results to advise you on the path and courses required to obtain a cpa designation. It takes at least six years to become a chartered professional accountant as you first pursue a bachelor's degree, which can take three to four years.

First thing you need to do is enroll in a degree program. Obtaining a bachelor's degree from an. A bachelor’s degree in accounting can take.

Being an internationally trained accountant opens doors in ontario. The south african institute of chartered accountants (saica) is the foremost accountancy body in south africa and one of the leading institutes in the world. Different pathways can qualify you to become a cpa in canada and take the cpa professional education program (pep), but the.