Divine Tips About How To Apply For A Sales Tax Id

Who is required to obtain a georgia sales and use tax number?

How to apply for a sales tax id. Tax rates are also available online at utah sales & use tax rates or you can. You have three options for filing and paying your idaho sales tax: Businesses shipping goods into utah can look up their customer’s tax rate by address or zip code at tap.utah.gov.

Payroll taxes and wage withholding: You will need the following. Signed copy of lease agreement if leasing the property where the business will.

These are taxes held on your payroll (if you have employees). You may apply for an ein online if your principal business is located in the united states or u.s. The person applying online must have a valid.

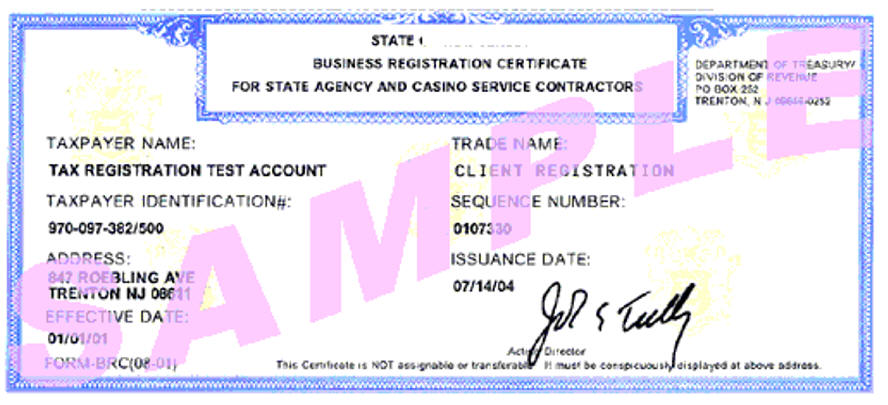

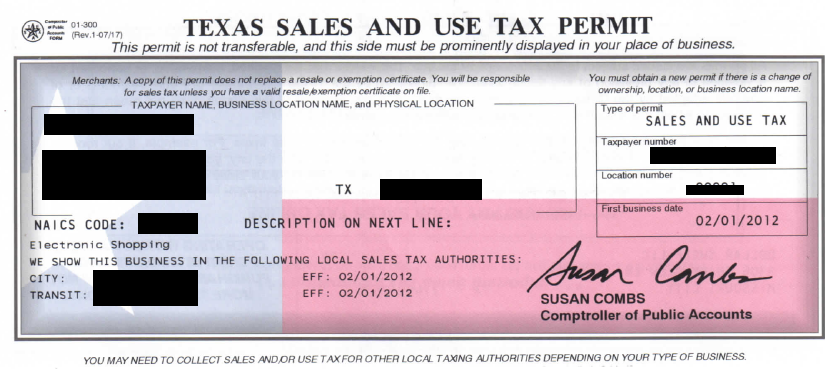

Home excise tax sales and use tax register for sales tax. Your state tax id and federal tax id numbers — also known as an employer identification number (ein) — work like a personal social security number, but for your business. Save your username and password.

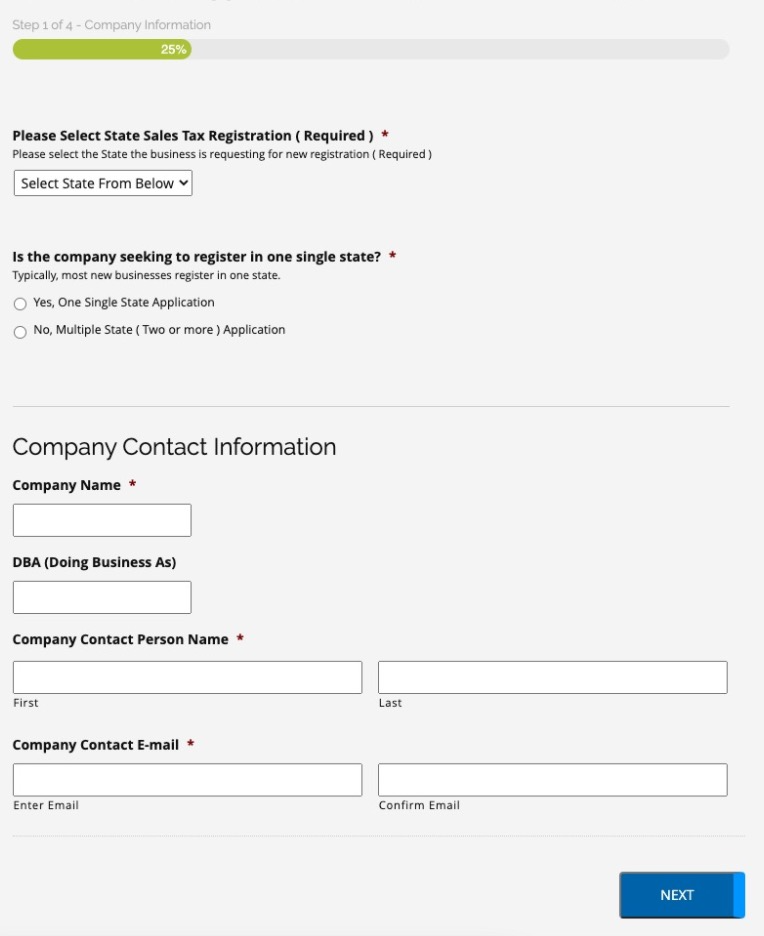

Register for a florida sales tax permit online by filling out and submitting the “florida sales tax application” form. Idaho adopted sales tax and use tax in 1965. If you are filing taxes after the event and do not have a license, you.

Businesses must use my alabama taxes (mat) to apply online for a tax account number for the following tax types. Your application will be processed and, if approved, we'll mail. Applying for tax exempt status.